M.S. Candidate: Caner Taş

Program: Information Systems

Date: 14.07.2023 / 13:30

Place: A-212

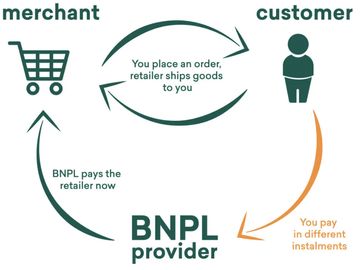

Abstract: Credit is one of the essential products for financial institutions, and credit risk management has gained importance after the 2008 financial crisis. Unregulated credit growth became one of the main reasons behind the crisis and led to more regulation in the credit sector. With the obligations imposed by the regulations, banks' priorities have shifted to reducing the risk in their loan portfolios by finding qualified customers, and credit risk forecasting has become necessary for them. In addition, the recent globalization of e-commerce and the emergence of new financial products have provided financial technology companies to make credit risk estimations, and credit risk management is not the just concern of banks. The differentiation and diffusion of new financial products from traditional credit products have led to observing different credit user behaviors; therefore, financial technology companies have preferred advanced machine learning algorithms over banks' standard credit risk models in the customers' credit risk prediction. In this study, we estimate the credit risks of users with the Buy Now Pay Later loan data set and compare the performance of standard and advanced artificial intelligence credit risk models in the credit risk prediction process. We collaborated with Colendi, one of Turkey's leading financial technology companies, and used the company's BNPL loan dataset. A comparative study is conducted on Logistic Regression, Probit, Random Forest, and LightGBM. Logistic Regression and Probit are standard credit risk models, and Random Forest and LightGBM are advanced credit risk models in the study. Model performances were measured with performance evaluation metrics such as recall, Roc curve, and confusion matrix. In addition, the features considered necessary by the models in the credit risk estimation process are analyzed and evaluated.