M.S. Candidate: Burcu Koç Göltaş

Program: Information Systems

Date: 06.09.2023 / 15:30

Place: A-212

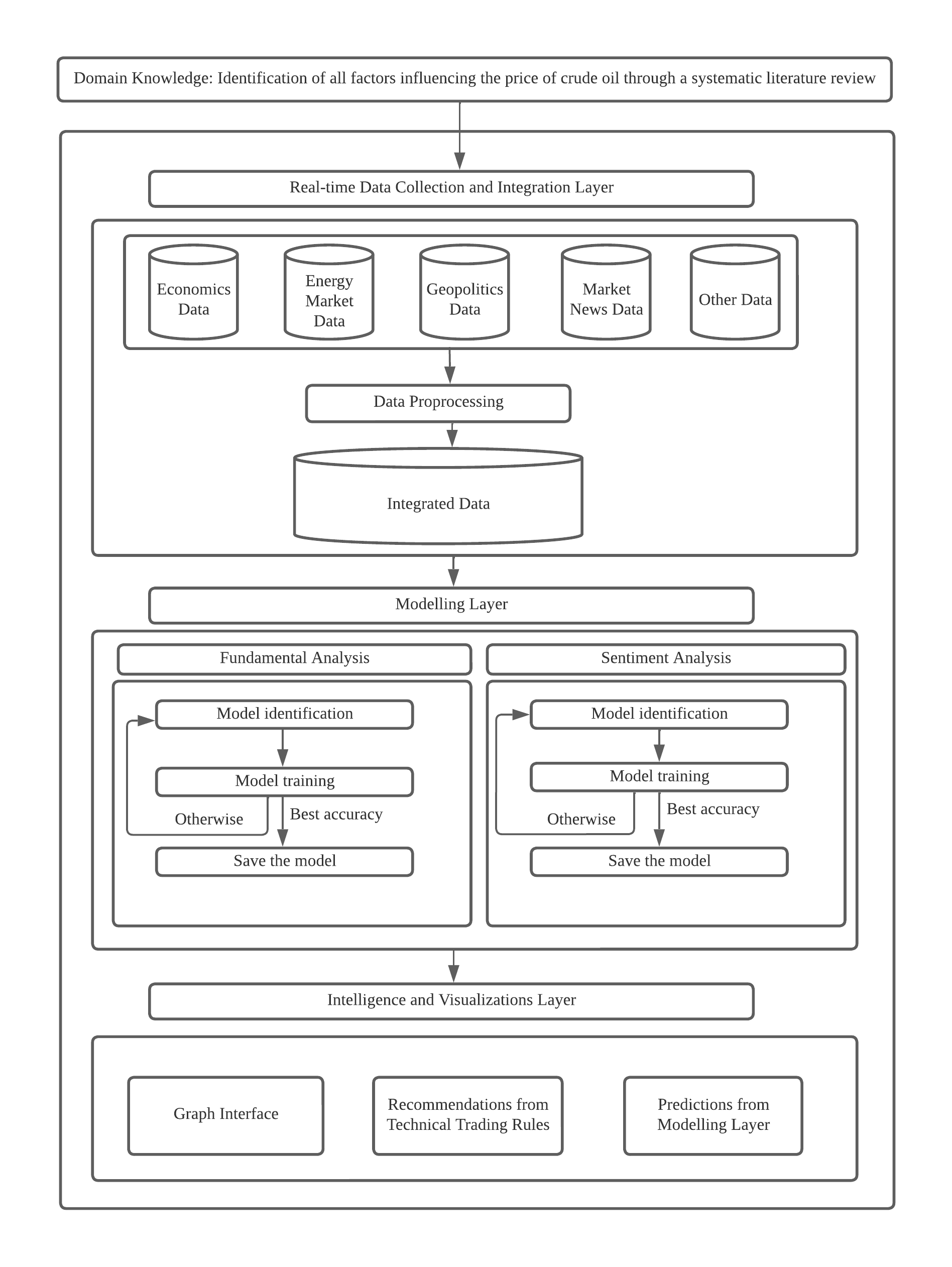

Abstract: Crude oil is one of the most traded commodities in the world. Traders engaged in the crude oil market for various purposes, such as generating profits and hedging price-related risks. Crude oil price is highly volatile as it is affected by a wide range of factors such as economic factors, political events, prices of other commodities, and financial instruments. Therefore, the biggest obstacle to profitable trading is the difficulty of keeping track of all factors affecting the market and the risks associated with price volatility. As a solution, this study examines all the factors that affect the crude oil market and provides an architecture for aggregating and processing these factors. It also holistically integrates technical, fundamental, and sentiment analysis methodologies and provides intelligent methods for their application to support crude oil trading decisions. A prototype of the proposed system was also implemented to demonstrate its applicability. This prototype demonstrates that predictive models accurately predict crude oil prices and that even the most basic trading methods may produce profitable outcomes.