M.S. Candidate: Ali Rıfat Kulu

Program: Information Systems

Date: 12.01.2026 / 13:30

Place: A-212

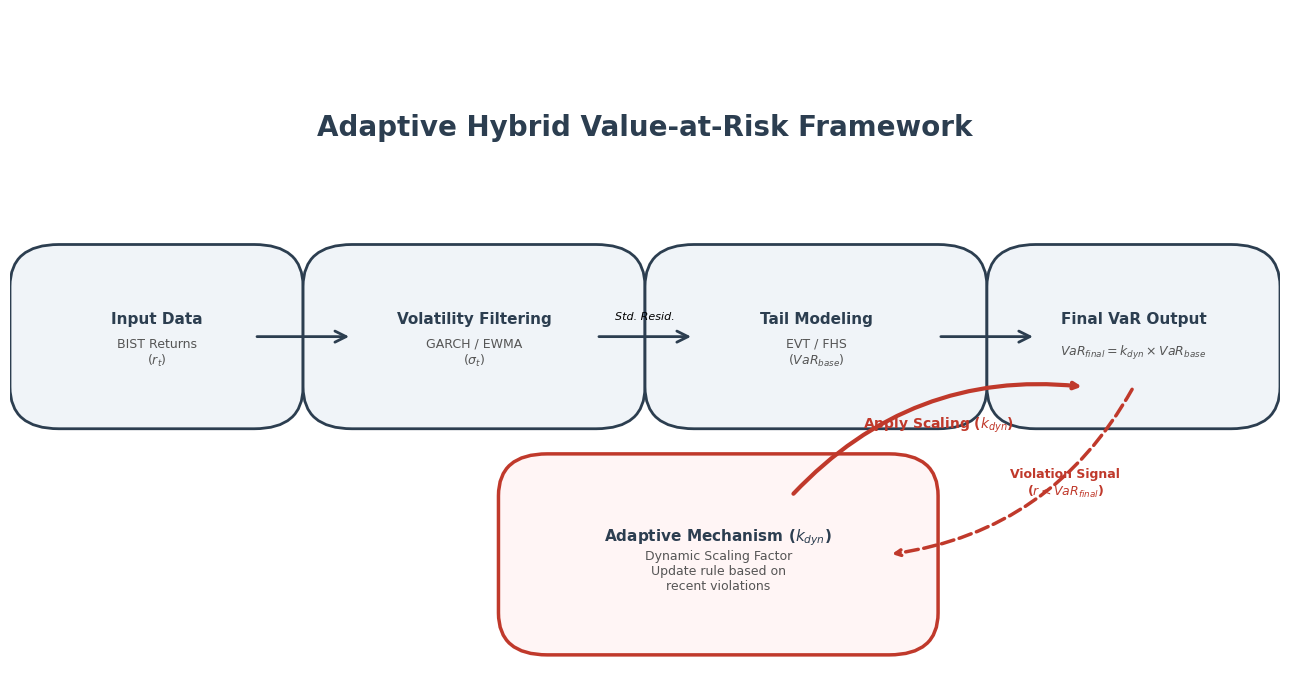

Abstract: Standard risk management frameworks, particularly those relying on the Value-at-Risk (VaR) metric under normality assumptions, might fail to capture the extreme volatility observed in emerging markets. This thesis evaluates the accuracy of market risk estimation models within the Borsa Istanbul (BIST) equity market, specifically focusing on the heavy-tailed characteristics of return distributions. We analyze the performance of parametric, non-parametric, and hybrid architectures including Generalized Autoregressive Conditional Heteroskedasticity (GARCH), Filtered Historical Simulation (FHS), and Extreme Value Theory (EVT) across a dataset of major Turkish equities. The empirical results demonstrate that traditional models consistently underestimate tail risk during periods of market stress. To address this limitation, we introduce a modular "Adaptive Risk Framework" that separates volatility scaling from tail shape estimation. A key contribution of this thesis is the development of a dynamic correction factor (k_dyn), which adjusts the risk forecast based on the latency of volatility tracking. Backtesting analysis reveals that the semi-parametric FHS model, combined with this adaptive mechanism, yields the most robust performance, achieving an 82.1% acceptance rate (for 23 out of 28 stocks) under strict Conditional Coverage tests. The findings confirm that for emerging markets like BIST, combining dynamic volatility filtering with empirical tail sampling is superior to relying on static distributional assumptions. To validate the mechanism's regime-dependency, we further tested the framework on a panel of 12 global assets, including S&P 500 and Bitcoin. From a practical perspective, the results highlight how adaptive volatility tracking can reduce systematic underestimation of risk in persistently volatile markets.